South African Reserve Bank (SARB) Governor Lesetja Kganyago has indicated that he favours ending the use of the prime lending rate, the benchmark commercial banks use to price trillions of rand in loans to consumers and businesses.

Speaking on Wednesday from the World Economic Forum in Davos, Switzerland, Kganyago said greater transparency in interest-rate pricing is needed.

“We would like to have much more transparency, so that consumers know what is actually going on,” Lesetja Kganyago said, adding that the “most natural outcome would be that we just get rid of prime.”

Prime Under Review

According to Bloomberg, earlier this month, the SARB confirmed it is conducting a review of the prime rate, which has been fixed at 350 basis points above the repo rate since 2001.

Currently, the repo rate stands at 6.75%, placing the prime rate at 10.25%. Banks typically use prime as a reference point when pricing loans, applying discounts or premiums based on factors such as funding costs, risk appetite and a customer’s credit profile.

Rate Decision Looms

The SARB’s Monetary Policy Committee (MPC) is due to meet next Thursday to review interest rates. Economists broadly expect rates to be held steady, although there is a small chance of a 25 basis point cut.

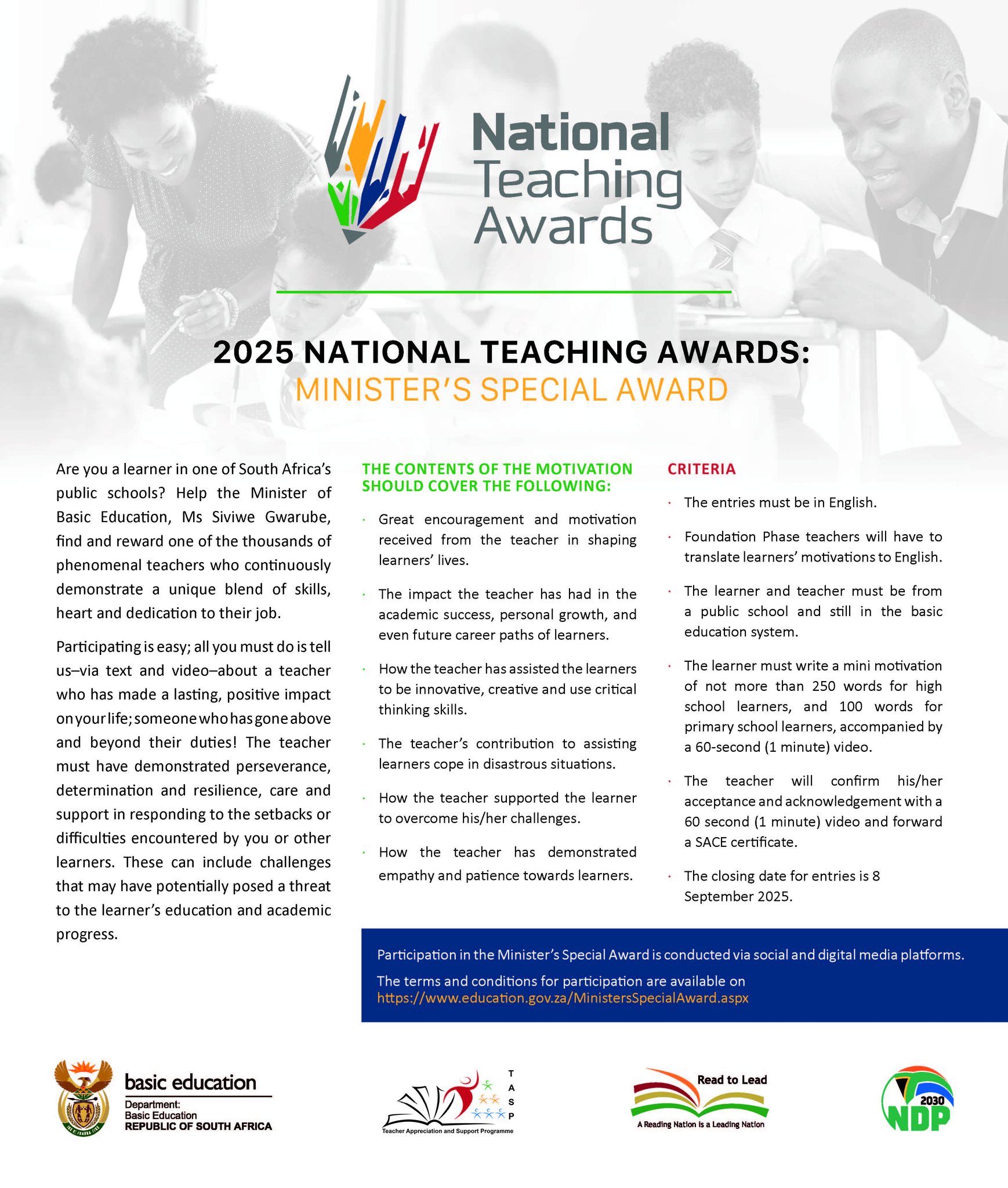

Who are the SARB’s MPC?

The South African Reserve Bank’s monetary policy committee meets every second month to announce changes – if any – to the country’s repo and prime lending rates.

The meetings are scheduled to take place in January, March, May, July, September and November – and always on a Thursday at 15:00.

Currently, the committee comprises of six people, with Lesetja Kganyago holding the position of governor of the SARB – and the deciding vote if necessary.

Image: Wikimedia Comms.